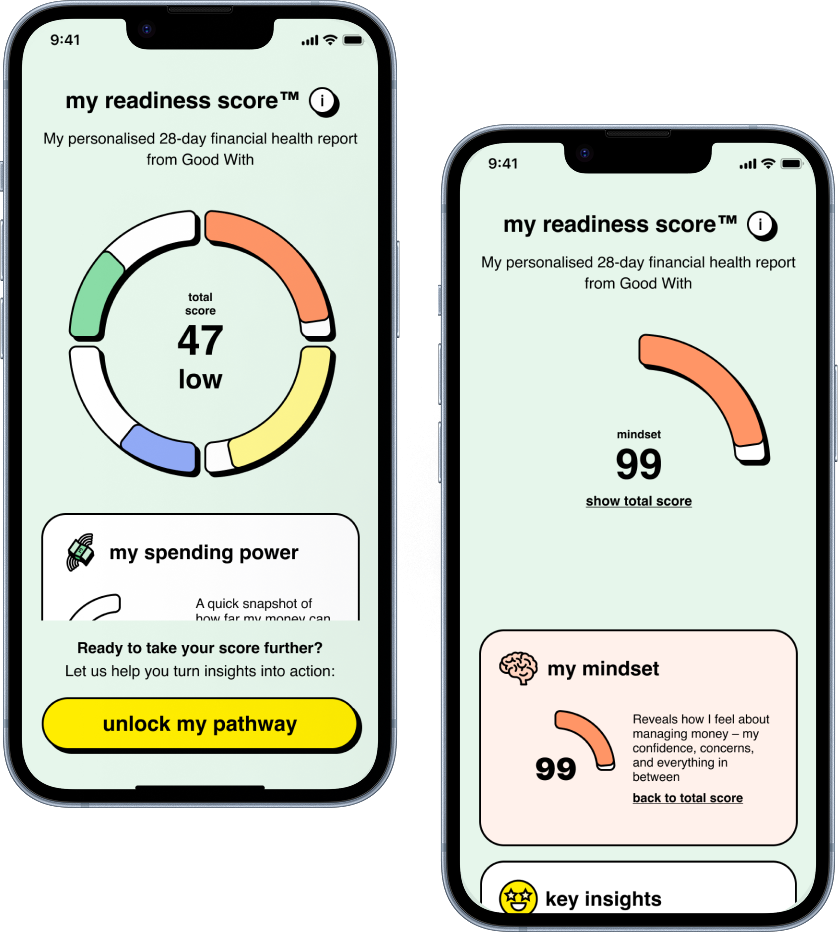

When it comes to money, everyone starts somewhere. Your Readiness Score™ is simply that: your starting point.

It’s not a credit score, not a pass/fail, and it’s not here to judge you. It’s simply a number out of 100 that shows where you are and, more importantly, points out the smallest, highest-impact steps you can take next. We use it to tailor the learning content you see so every lesson feels like it’s been made for you.

Not a credit score

Your Readiness Score™ is about readiness. It’s built from your real-time habits with money and your answers to questions about your financial wellbeing. It doesn’t directly affect your credit file. Instead, it helps us choose the right learning path so you can build real, lasting confidence before taking your next step.

Once you’ve built your score, we’ll tailor your lessons and insights — whether that’s learning to manage impulsive spending, tackle stress, or grow confidence around borrowing and credit. The better we understand your starting point, the better we can support your progress.

How we build your score

Your Readiness Score™ is created using two things:

- Your answers to questions about your financial health and wellbeing. They’re focused on things like everyday feelings, habits, and stress about money.

- Insights from your connected bank accounts, which help us understand your everyday patterns with your money.

Together, these build a picture of your financial health and wellbeing, powered by behavioural science and designed to help you grow step by step. Always with your data fully secure and private.

Why personalised learning matters

Two people with the same bank balance might need very different things. One might need help with planning and goals, the other with impulse control or anxiety around bills.

Your Readiness Score™ picks content that fits you — so you don’t waste time on lessons that don’t help.

A score that evolves with you

Your Readiness Score™ isn’t fixed. It evolves with you. As you step along your personalised learning path, apply what you learn, and make positive changes to how you think and act around money, your score updates to reflect your progress. We check in every 30 days to reflect and celebrate your progress.

Because you deserve to feel good with money

Your Readiness Score™ is just the first step. Towards borrowing, building credit, or simply feeling good with money.

It makes learning useful, fast, and personal. And it’s designed so that small, practical steps lead to real confidence.

If you’re curious about where you are and what small change would help most, unlock your Readiness Score™ and see your personal learning path waiting for you.